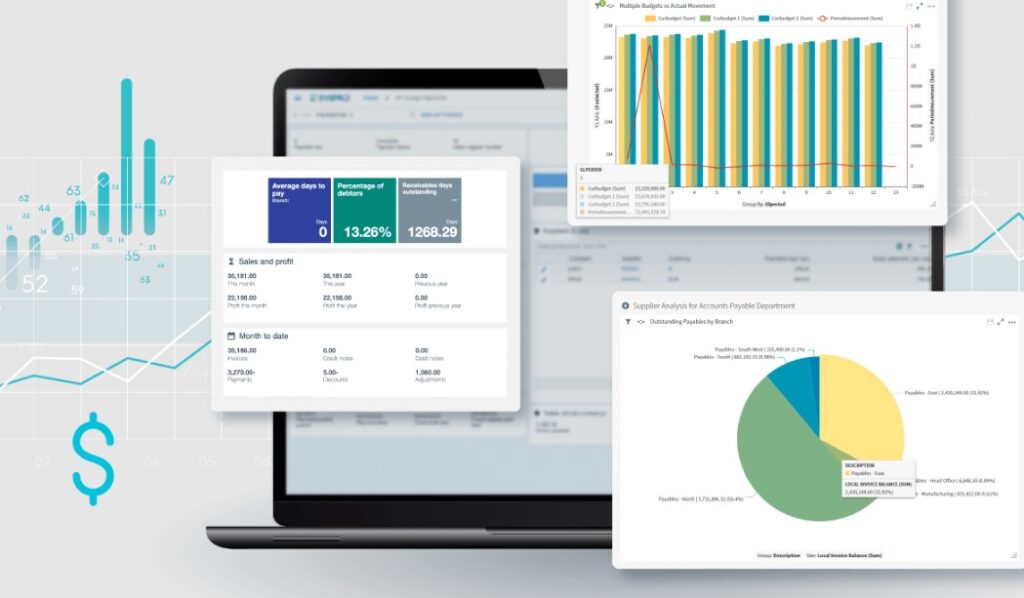

Managing financial operations effectively is critical for the success of any business. ERP software for financial management helps organizations streamline their financial processes, ensuring accurate reporting, real-time insights, and improved decision-making. By integrating financial data with other business processes like inventory, HR, and supply chain management, ERP software provides a comprehensive view of your company’s financial health.

In this article, we will explore the top ERP software solutions for financial management, highlight their benefits, provide real-world product examples, and offer a detailed comparison to help you choose the best solution for your business.

What is ERP Software for Financial Management?

ERP software for financial management is a comprehensive solution designed to help businesses manage their financial processes, integrate core accounting tasks, and provide real-time insights into financial performance. ERP (Enterprise Resource Planning) software typically combines various business operations—such as inventory, human resources, supply chain, and customer relationship management (CRM)—into one unified platform. However, its financial management component is critical for ensuring that a business operates efficiently, remains compliant with regulations, and supports informed decision-making.

Key Components of ERP Software for Financial Management

ERP software for financial management encompasses several core functionalities that are essential for the accurate and efficient management of a company’s financial operations. These include:

- General Ledger: The general ledger (GL) is the heart of the financial management system. It records all financial transactions within the company, including revenue, expenses, assets, liabilities, and equity. This module integrates with other functions such as accounts payable, accounts receivable, payroll, and inventory, allowing for comprehensive financial reporting.The general ledger serves as the foundation for generating financial statements such as income statements, balance sheets, and cash flow reports, providing a clear view of a company’s financial health.

- Accounts Payable and Accounts Receivable: ERP systems automate the management of incoming and outgoing payments. Accounts payable tracks a company’s debts and obligations to vendors, while accounts receivable manages customer payments and outstanding invoices. By automating these processes, businesses can streamline cash flow management, reduce manual errors, and improve the speed of payment collection.

- Financial Reporting and Analysis: One of the most valuable features of ERP software for financial management is its ability to generate real-time financial reports. These reports provide insights into the company’s financial performance, enabling managers to make data-driven decisions. Reports like profit and loss statements, balance sheets, and budget forecasts are available at the click of a button, which simplifies strategic planning and decision-making.

- Budgeting and Forecasting: ERP financial management tools offer budgeting and forecasting capabilities that help businesses plan for future financial needs. These tools use historical financial data to forecast future revenues and expenses, allowing businesses to create realistic budgets. By comparing actual performance against the budget, companies can make necessary adjustments to improve financial health.

- Cash Flow Management: Maintaining healthy cash flow is essential for any business. ERP systems help businesses monitor and manage their cash flow by tracking incoming and outgoing payments, ensuring that companies have the liquidity needed to meet their obligations.

- Fixed Asset Management: ERP financial systems manage a company’s fixed assets—such as machinery, buildings, and equipment—by tracking their lifecycle from acquisition to disposal. This includes calculating depreciation, monitoring maintenance schedules, and ensuring assets are utilized efficiently.

- Audit and Compliance Management: ERP software for financial management ensures compliance with regulatory standards by automating processes such as tax calculations, reporting, and audit trails. For businesses operating in industries with strict financial regulations (e.g., healthcare, finance), this feature helps avoid penalties and maintain operational integrity.

How ERP Software for Financial Management Works

At its core, ERP software for financial management consolidates financial data from across the organization into one unified platform. This allows financial data from different departments (e.g., HR, procurement, sales) to be integrated and analyzed in real-time. For example, when an order is placed, it triggers inventory adjustments, generates an invoice, records the sale in the general ledger, and tracks the payment in accounts receivable—all within the same system. This seamless integration improves operational efficiency, eliminates redundant tasks, and reduces the risk of errors.

By providing real-time access to financial data, ERP systems enable businesses to:

- Monitor financial performance across various departments.

- Track cash flow and ensure liquidity.

- Analyze historical data for future planning.

- Ensure compliance with financial regulations by automating reporting and audit processes.

ERP software for financial management also supports multi-currency and multi-entity operations, making it ideal for businesses operating in multiple countries or regions. These systems allow companies to manage different currencies, tax laws, and financial regulations with ease, ensuring accurate financial reporting across global operations.

Why ERP Software for Financial Management is Important

Implementing ERP software for financial management is crucial for businesses looking to scale, improve operational efficiency, and make informed decisions. Here’s why:

- Centralized Financial Data: Without an ERP system, financial data is often scattered across multiple departments and software systems, making it difficult to get a holistic view of a company’s financial health. ERP software centralizes all financial data in one place, providing accurate, real-time information to stakeholders. This reduces the need for manual data entry and ensures that financial reports are based on the latest data.

- Increased Financial Accuracy and Reduced Errors: Financial errors can lead to costly penalties, missed opportunities, and compliance issues. ERP software automates financial tasks such as data entry, invoicing, and reporting, reducing the chances of errors and improving accuracy. With an ERP system, financial processes are streamlined, resulting in faster and more reliable reporting.

- Enhanced Compliance and Auditing: Adhering to financial regulations is critical, especially for companies operating in industries with strict regulatory requirements. ERP systems help businesses stay compliant by automating reporting and audit processes, ensuring that financial statements meet regulatory standards. This also simplifies the auditing process by providing a comprehensive audit trail of all financial transactions, making it easier to trace back any discrepancies.

- Improved Decision-Making: Real-time access to financial data enables businesses to make informed decisions quickly. With ERP systems, financial managers and executives can monitor key performance indicators (KPIs), analyze trends, and make data-driven decisions. This helps businesses adapt to market changes, optimize cash flow, and identify new growth opportunities.

- Cost Savings and Operational Efficiency: ERP software eliminates the need for multiple financial management tools, reducing operational costs and improving efficiency. By automating routine financial tasks, businesses can focus on strategic initiatives rather than spending time on manual processes. In the long run, ERP systems lead to significant cost savings, improved productivity, and a more efficient financial workflow.

Benefits of ERP Software for Financial Management

Implementing ERP software for financial management offers numerous benefits, including:

1. Real-Time Financial Insights

ERP systems provide up-to-the-minute financial data, helping businesses stay updated on their financial health. This ensures accurate forecasting, better cash flow management, and timely decision-making.

2. Improved Financial Accuracy

Manual data entry and disconnected systems often lead to errors in financial reporting. ERP software automates financial processes, reducing human errors and ensuring precise reporting.

3. Enhanced Compliance and Auditing

ERP systems automate compliance tracking and auditing, helping businesses adhere to local and international financial regulations. The system generates audit trails and stores critical data securely for future reference.

4. Cost Savings

By automating routine financial tasks such as invoicing, payroll, and financial reporting, ERP systems reduce labor costs and operational inefficiencies. This leads to significant cost savings over time.

5. Scalability and Flexibility

ERP systems are scalable and can grow with your business, adapting to new financial needs as they arise. Whether you’re expanding internationally or introducing new financial products, ERP systems offer the flexibility to handle complex financial operations.

Top ERP Software for Financial Management: Product Comparison

Below, we will explore five popular ERP software solutions specifically designed to enhance financial management. Each product offers unique features and pricing, so you can select the best one for your needs.

1. SAP S/4HANA Finance

SAP S/4HANA Finance is a comprehensive ERP system for large enterprises that require advanced financial management capabilities.

- Features: Real-time financial data, AI-driven insights, integrated risk management, automated financial close.

- Use Case: Ideal for large multinational companies with complex financial operations.

- Pros: Industry-leading financial analytics, extensive customization options.

- Cons: High upfront costs, complex implementation.

- Price: Starts at $1,500/user/month.

- Where to Buy: Directly from SAP’s website.

2. Oracle NetSuite

Oracle NetSuite is a cloud-based ERP solution suitable for mid-sized businesses seeking scalability and advanced financial tools.

- Features: Cloud-based accounting, real-time reporting, revenue recognition, expense management.

- Use Case: Best for growing companies that need flexible financial management tools.

- Pros: Cloud-native, easy scalability, robust financial controls.

- Cons: Can be expensive with customizations.

- Price: Starting at $999/user/month.

- Where to Buy: Available at NetSuite’s website.

3. Microsoft Dynamics 365 Finance

Microsoft Dynamics 365 Finance integrates financial management with the broader Microsoft ecosystem, making it perfect for companies using Microsoft products.

- Features: AI-driven forecasting, automated financial processes, expense management, integrated HR and CRM.

- Use Case: Ideal for companies using Microsoft tools such as Office 365 and Azure.

- Pros: Seamless integration with Microsoft apps, powerful analytics tools.

- Cons: Requires extensive training for full utilization.

- Price: Starts at $190/user/month.

- Where to Buy: Purchase from Microsoft Dynamics.

4. Infor CloudSuite Financials

Infor CloudSuite Financials offers specialized ERP solutions for industries such as healthcare, retail, and manufacturing.

- Features: Comprehensive financial management, budget planning, risk and compliance management, advanced analytics.

- Use Case: Best for industry-specific financial needs, such as healthcare organizations needing strong compliance tracking.

- Pros: Tailored for specific industries, advanced reporting.

- Cons: Requires industry-specific customization.

- Price: Custom pricing based on needs.

- Where to Buy: Available at Infor’s website.

5. Odoo Accounting

Odoo Accounting is an open-source ERP solution, making it a cost-effective choice for small to medium-sized businesses.

- Features: Basic accounting, invoicing, bank reconciliation, tax management.

- Use Case: Perfect for small businesses looking for an affordable ERP solution.

- Pros: Cost-effective, customizable.

- Cons: Limited features compared to more expensive ERPs.

- Price: Free for basic use, premium starts at $24/user/month.

- Where to Buy: Available from Odoo’s website.

Comparison Table: ERP Software for Financial Management

| Product | Use Case | Pros | Cons | Price | Features |

|---|---|---|---|---|---|

| SAP S/4HANA Finance | Large enterprises | Industry-leading analytics | High cost, complex setup | $1,500/user/month | Real-time financial data, AI-driven insights |

| Oracle NetSuite | Mid-sized businesses | Cloud-native, scalable | Expensive with customizations | $999/user/month | Real-time reporting, revenue recognition |

| Microsoft Dynamics 365 Finance | Companies using Microsoft tools | Seamless integration, powerful analytics | Requires training | $190/user/month | AI-driven forecasting, integrated CRM/HR |

| Infor CloudSuite Financials | Industry-specific organizations | Tailored solutions, advanced reporting | Requires customization | Custom pricing | Budget planning, risk management |

| Odoo Accounting | Small to medium businesses | Cost-effective, customizable | Limited features | $24/user/month | Basic accounting, tax management |

Use Cases: Problems ERP Systems for Financial Management Solve

1. Manual Financial Processes

Manually managing finances using spreadsheets or disparate systems can lead to errors, inefficiencies, and delayed decision-making. ERP systems automate these processes, ensuring accuracy and saving time.

2. Lack of Real-Time Financial Data

Without real-time insights, businesses may miss critical financial trends or opportunities. ERP software provides up-to-date financial data, allowing businesses to make informed decisions quickly.

3. Compliance and Regulatory Challenges

Businesses operating in highly regulated industries must comply with various financial regulations. ERP systems automate compliance tracking and reporting, reducing the risk of non-compliance.

Where to Buy ERP Software for Financial Management

Purchasing ERP software involves evaluating your needs, requesting demos, and selecting the right pricing plan. Below are the buying options for the ERP solutions mentioned:

- Buy SAP S/4HANA Finance

- Purchase Oracle NetSuite

- Get Microsoft Dynamics 365 Finance

- Contact Infor CloudSuite for Pricing

- Buy Odoo Accounting

FAQs

1. How does ERP software improve financial management? ERP software automates financial tasks, provides real-time insights, and ensures accuracy in financial reporting, helping businesses manage their finances more effectively.

2. What is the typical cost of ERP software for financial management? Prices vary based on the solution and company size. For example, SAP S/4HANA starts at $1,500/user/month, while Odoo offers free basic accounting features.

3. Can ERP systems be customized for specific industries? Yes, ERP systems like Infor CloudSuite Financials are designed for industry-specific needs, offering tailored modules for healthcare, retail, manufacturing, and more.

4. How long does it take to implement ERP software? The implementation timeline depends on the complexity of the system. On average, it takes 6 to 12 months to fully implement an ERP system.

5. Are there ERP options for small businesses? Yes, ERP systems like Odoo offer affordable, open-source options tailored to small businesses.

By choosing the right ERP software for financial management, businesses can enhance efficiency, ensure compliance, and gain a real-time view of their financial health, ultimately positioning themselves for long-term success.